Author

Data Analyst

Published

August 5th, 2024

Length

4 Minutes

The final decision has been delivered, and it’s a game-changer for buyers & designers of retail paper bags delivered to the U.S. market.

If this is news to you, it’s time to catch up.

The U.S. Department of Commerce and the International Trade Commission have issued antidumping and countervailing duty (AD/CVD) orders on paper shopping bags from Cambodia, China, Colombia, India, Malaysia, Portugal, Taiwan, and Vietnam.

This ruling imposes substantial duties ($$$) on imports from these 8 countries, and the ripple effects will undoubtedly be felt by procurement officers and CFOs at luxury brands.

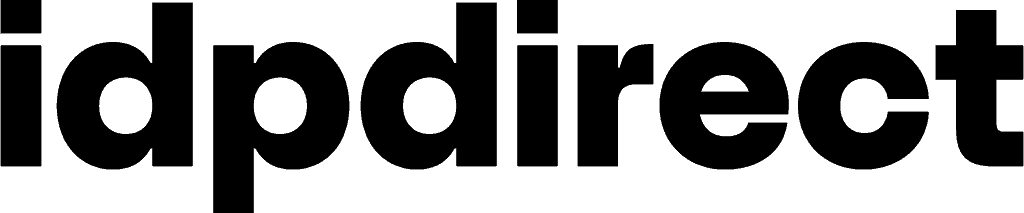

Bag Specifications Covered in AD/CVD Ruling

The scope of the orders includes paper shopping bags with handles of any type.

Bags can be made from kraft paper or from any cellulose fiber, paperboard, or pressboard including a basis weight of less than 300 grams per square meter (GSM), must have a minimum width of 4.5 inches and a depth of at least 2.5 inches.

How the top edges are finished does not matter, this includes fold over, reinforced, or serrated tops. Bags may or may not have any printing or adhesive for sealing.

Bags that meet this criteria are now subject to the new duties. See Fig. 1 below.

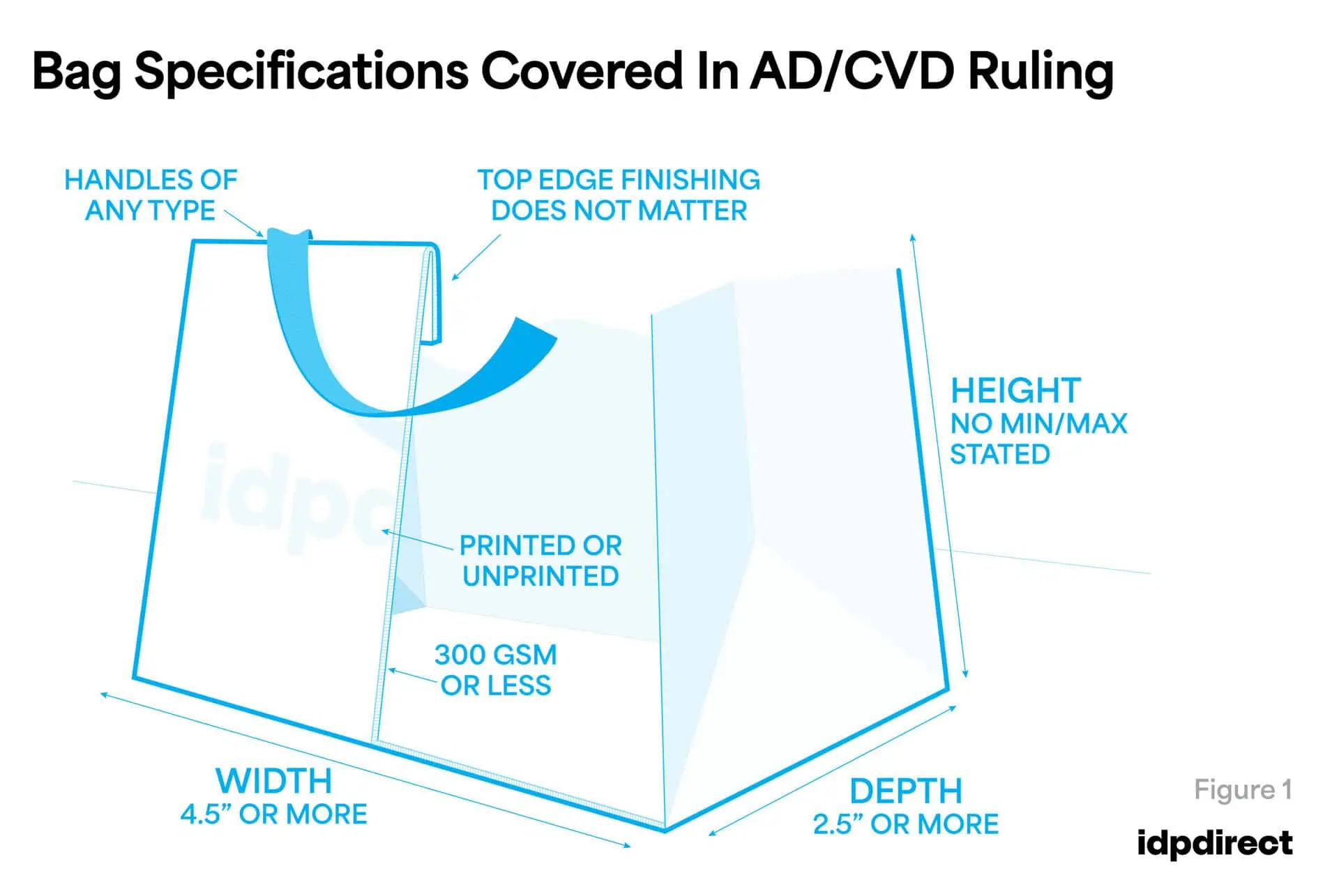

Handle Types Covered by AD/CVD Ruling

The ruling is thorough in its inclusion of all handle types. Whether your bags use twisted paper, flat paper, rope, ribbon, string, or plastic handles, or even die-cut handles, they are all subject to the new duties. See Fig. 2 below.

This comprehensive approach means that no matter the design, if your bags are sourced from the affected countries, they will incur significant additional costs.

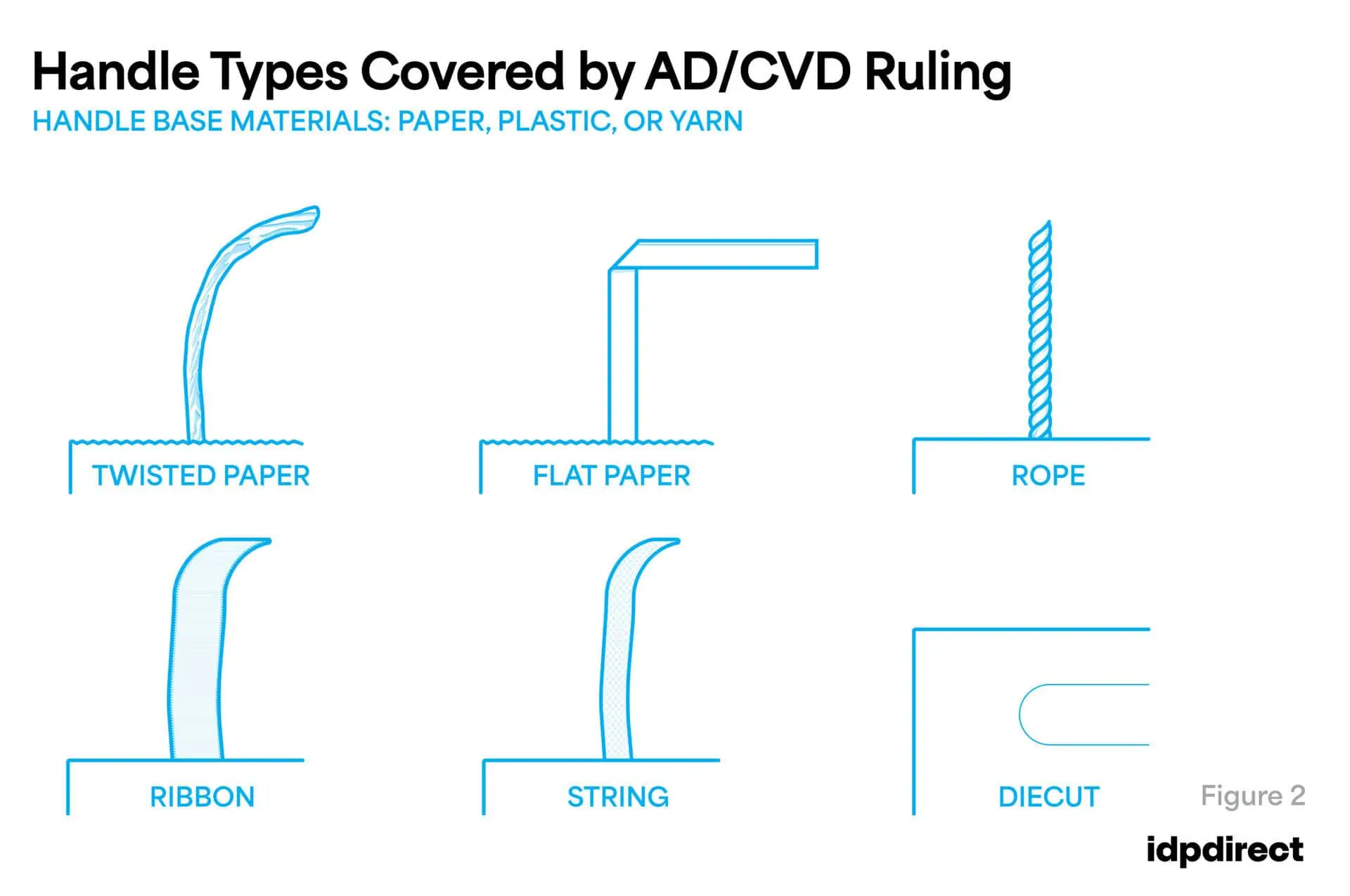

Handle Exceptions

The only applicable exception are t-bar handles and knotted handles which honestly speaking, compromise the consumer experience and a brand’s premium image.

See Fig. 3 below.

You’ve Been Warned: Circumventing the Duties

Packaging distributors and resellers have tried various tactics to sidestep these duties putting brands like yours at risk of heavy fines or having your goods seized at the port.

Examples of this sidestepping include misclassifying bags under false Harmonized Tariff Schedule (HTS) codes replacing the HTS codes for paper bags with fruits, furniture, and other goods that are not bags. Another example includes misrepresenting the sizes of the bags shipped to fall within the exceptions. These risky practices won’t work, as customs are now vigilant against such practices and looking to make an example of an importer.

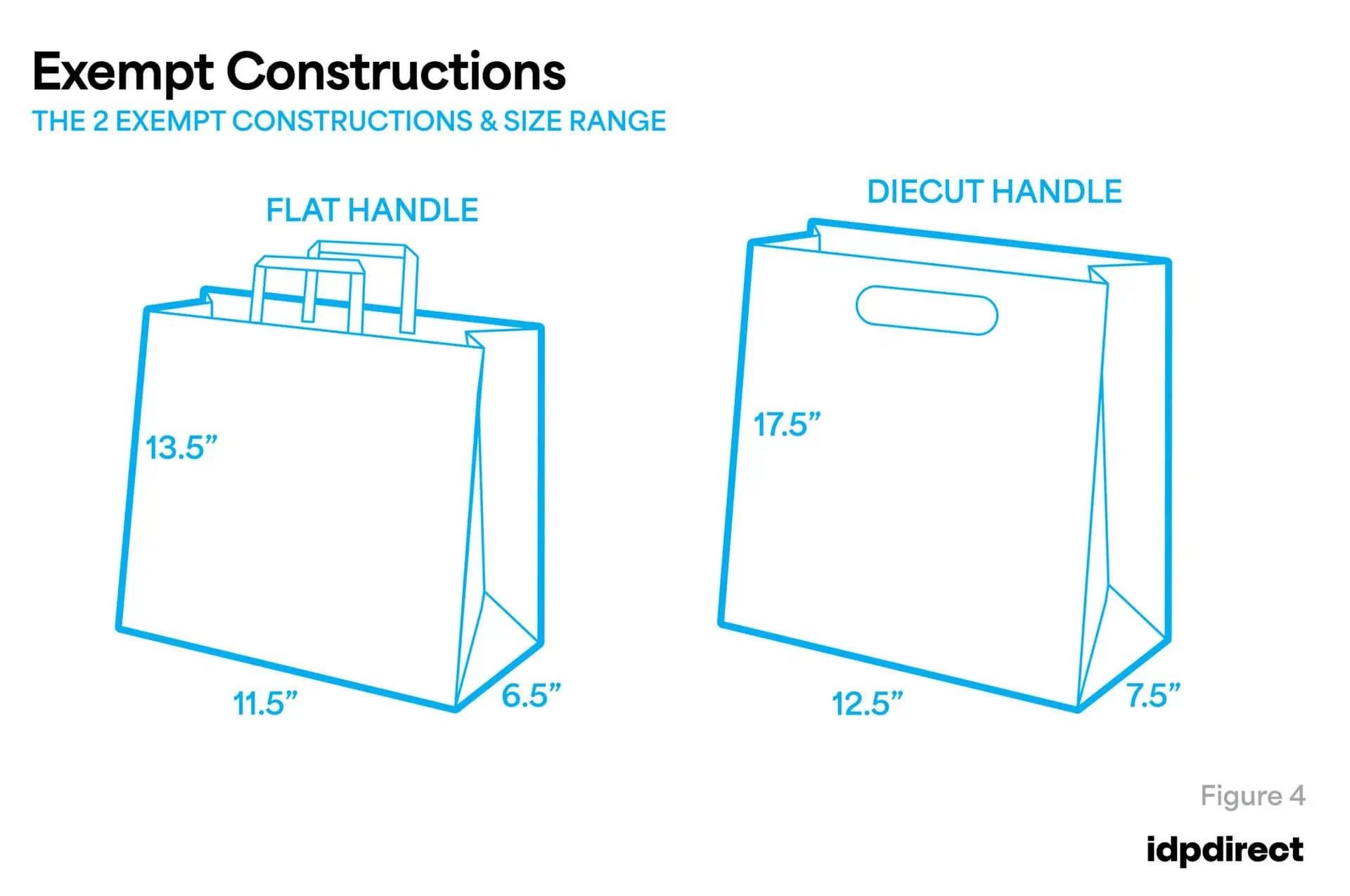

Additionally, limiting the sizes of paper bags to dimensions just outside the scope of the ruling is futile. The regulations explicitly cover a broad range of sizes and types, making these attempts ineffective and ensuring that nearly all luxury retail paper bags will be impacted.

See Fig. 4 above.

Impact of HTS Codes on Import Requirements

The new AD/CVD orders will significantly impact the HTS codes used when importing paper bags. Customs will closely scrutinize the codes to ensure compliance. Importers must ensure that the correct HTS codes are used to classify their products accurately. Misclassification or use of incorrect HTS codes to avoid duties can lead to severe penalties, including fines and seizure of goods. The relevant HTS subheadings for these paper shopping bags are 4819.30.0040 and 4819.40.0040.

Importers need to be diligent in their documentation and ensure all import declarations are accurate to avoid any legal issues and additional costs.

Avoid Antidumping Duties with IDP Direct

At IDP Direct, we cut through the confusion with transparency and solutions that align with your brand’s needs.

Several of the paper bag production facilities owned by IDP Direct are located outside of the 8 countries listed by the ITC Order and are entirely unaffected by these new AD/CVD orders. This means we can continue to deliver the same beautiful, luxury retail bags that your brand relies on, without the additional costs and compliance headaches.

Our business model is simple and effective: we produce high-quality, luxury packaging solutions outside the regions affected by these duties, ensuring that your costs remain stable and predictable. By leveraging our manufacturing facilities in Mexico and other non-affected countries, we legally side-step these new duties entirely.

Our production capabilities include making knitted paper ribbons and high-quality paper bags, ensuring compliance with U.S. standards while maintaining proximity to reduce carbon footprints. We know brands are concerned they will be forced to take several steps backwards and move to poly ribbon handles, but this is not true. You can continue to support sustainable and recyclable paper bags with IDP Direct.

*We advise all brands to have their own legal representation review the documents for themselves, this is not legal advice. Download your own copy of the finalized order from the ITC here.