Author

Logistics Manager

Published

April 3rd, 2025

Length

2 Minutes

10% Tariff. 100% Disruption.

Trump’s “Liberation Day” tariff plan has dropped a seismic shift into the packaging world with a 10% blanket tariff on all imports and up to 54% on goods from China. But what does this mean for packaging buyers, brand managers, and procurement leads?

Here’s the short answer: massive risk, sneaky costs, and strategic opportunity.

If you’re searching for “Trump tariffs impact on packaging,” this is the intel you need before making a costly mistake.

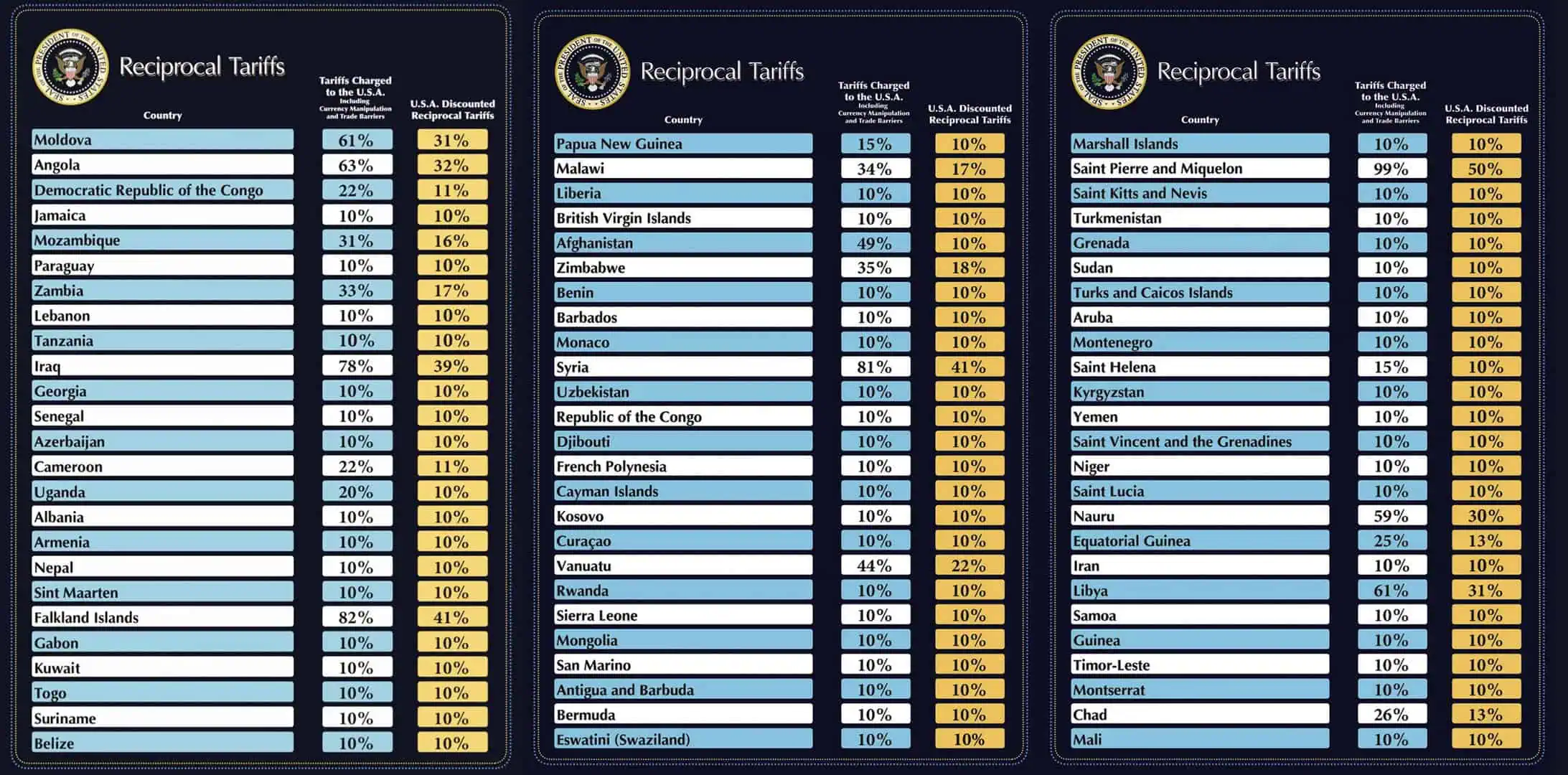

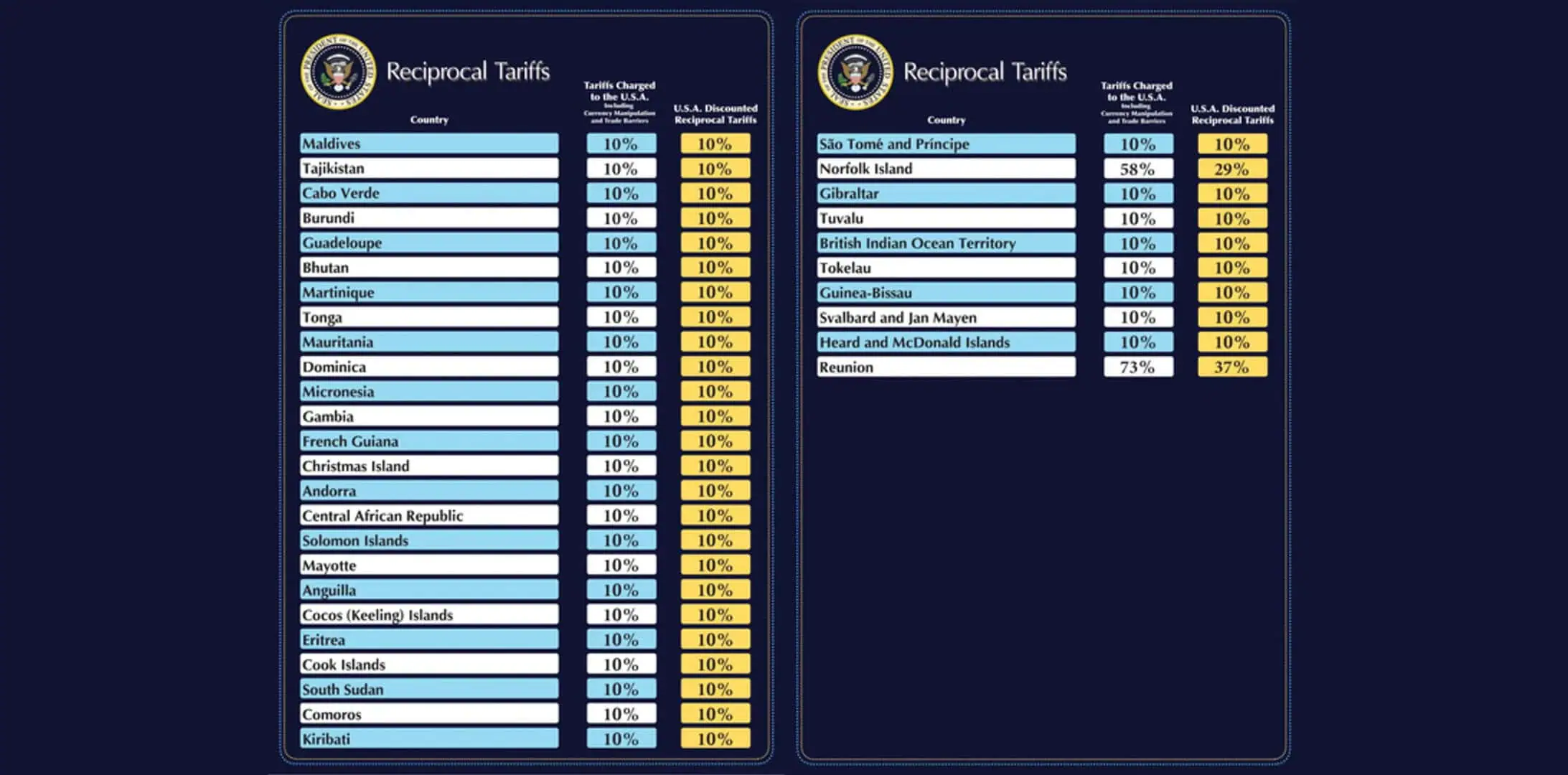

See full list of tariffs at bottom of article.

What Are the New Trump Tariffs?

Under this new trade proposal, countries that don’t lower their tariffs on U.S. goods will face “reciprocal tariffs”—a tactic designed to pressure foreign governments but with real-world fallout for U.S. businesses importing packaging and raw materials.

Key rates:

- 10% base tariff on all imports

- Up to 54% on China

- 20% on EU

- 24% on Japan

These tariffs are not permanent. They are political leverage. They may drop in days or linger for years.

How Trump Tariffs Impact Packaging Buyers

Tariffs on packaging materials, printed boxes, inserts, and accessories create uncertainty in every part of your supply chain—from material sourcing and freight costs to fulfillment and cash flow.

Before you start switching suppliers, re-quoting SKUs, or overpaying in panic, here are 10 things every smart packaging buyer should know right now:

1. These Reciprocal Tariffs Are a Threat, Not a Law

These Trump tariffs are designed to pressure foreign governments, not necessarily stick around forever. A country that reduces its tariffs on U.S. goods could see these rates drop just as fast as they appeared. Making a drastic supply chain shift right now might leave you stuck with a slower, costlier partner when tariffs are gone.

2. Switching Suppliers Isn’t Fast—Or Risk-Free

Vetting new packaging suppliers can take 60–120 days or longer. Material tests, compliance checks, pre-production samples all take time. Rushing that process could mean working with suppliers who are dodging tariffs through transshipment, risking seizure, penalties, or worse.

3. Focus on Total Cost of Packaging Ownership (TCO)

It’s not just about box cost. What are freight rates from a new supplier? What’s the impact on inventory turnover, cash flow, storage fees, or quality control? Total cost of ownership (TCO) needs to be your guiding light, not unit price panic. TCO > unit price, always.

4. Use This Disruption to Right-Size Your Packaging

Now is the time to audit every box, tray, and insert. Cut slack fill. Eliminate void space. Optimize your dimensional weight to save on both materials and shipping. Structural packaging design isn’t just a creative discipline it’s your new profit center.

5. Get Ahead With Strategic Stockpiling

If you’ve vetted a reliable supplier but are worried about rising costs, consider short-term overbuying to bridge the gap while tariffs shake out. But beware: storage fees and obsolescence can kill the gains. Make it a data-driven move.

Don’t forget to model out:

- Storage costs

- Risk of obsolescence

- Cash flow impact

6. Don’t Assume Domestic Is Cheaper

Many brands are racing back to U.S. suppliers, but labor and material costs may eat the tariff savings. Plus, a surge in demand could inflate local prices or extend lead times. Run both scenarios before you switch.

7. Get Your Finance Team Involved—Now

Work with your finance team to model out tariff impact vs. switching costs. Don’t assume they understand your supply chain dynamics show them. Share scenarios, timelines, and potential risks.

8. Build Flexibility Into Your Contracts

Renegotiate terms that give you volume flexibility, multi-source capability, and cost review clauses. If tariffs drop or rise, you’ll want to pivot fast without getting locked into the wrong price or volume. An agile packaging partner is your #1 asset in a shifting trade landscape.

9. Watch for Material Substitutions from Packaging Suppliers

Some suppliers will offer “equivalent” materials to dodge costs, but are they brand-safe? Can they be recycled in the same streams? Always confirm performance, compliance, and sustainability claims.

10. Design for Resilience, Not Just Cost

This is your moment to push packaging out of the cost column and into the value column. Focus on user experience, sustainability, and supply chain resilience. What you do now will shape how your brand rides out the next disruption.

Focus on designs that:

- Use modular sizes across SKUs

- Minimize material complexity

- Ship flat, nest, or collapse efficiently

In short: Packaging that performs under pressure.

Bottom Line: Don’t just survive this tariff storm use it. Optimize what you can control (structure, sourcing strategy, supplier communication), and stay agile where you can’t (policy shifts, trade deals). The brands that win aren’t the ones that panic, they’re the ones that prepare smart and design smarter.

Want help auditing your packaging design for tariff resilience?

The IDP Direct team specializes in cost-optimized, structurally engineered packaging that performs globally.

Let’s talk strategy before tariffs eat your margin.

info@IDPdirect.com